A savings account is a bank account at a retail bank. Common features include a limited number of withdrawals, a lack of cheque and linked debit card facilities, limited transfer options and the inability to be overdrawn. Traditionally, transactions on savings accounts were widely recorded in a passbook, and were sometimes called passbook savings accounts, and bank statements were not provided; however, currently such transactions are commonly recorded electronically and accessible online.

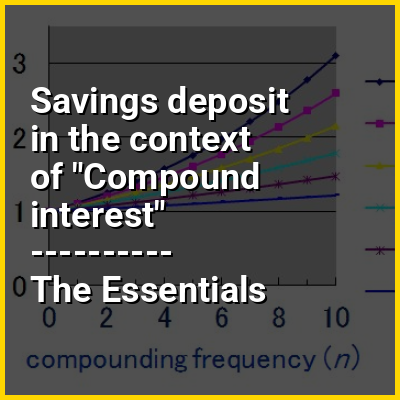

People deposit funds in savings account for a variety of reasons, including a safe place to hold their cash. Savings accounts normally pay interest as well: almost all of them accrue compound interest over time. Several countries require savings accounts to be protected by deposit insurance and some countries provide a government guarantee for at least a portion of the account balance.