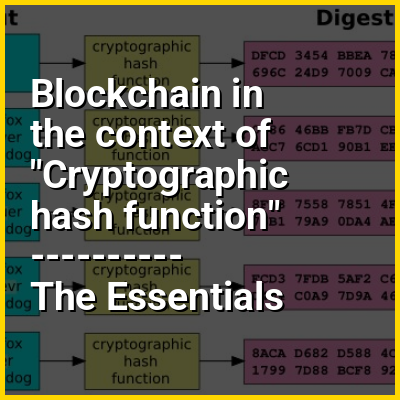

A blockchain is a distributed ledger with growing lists of records (blocks) that are securely linked together via cryptographic hashes. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data (generally represented as a Merkle tree, where data nodes are represented by leaves). Since each block contains information about the previous block, they effectively form a chain (compare linked list data structure), with each additional block linking to the ones before it. Consequently, blockchain transactions are resistant to alteration because, once recorded, the data in any given block cannot be changed retroactively without altering all subsequent blocks and obtaining network consensus to accept these changes.

Blockchains are typically managed by a peer-to-peer (P2P) computer network for use as a public distributed ledger, where nodes collectively adhere to a consensus algorithm protocol to add and validate new transaction blocks. Although blockchain records are not unalterable, since blockchain forks are possible, blockchains may be considered secure by design and exemplify a distributed computing system with high Byzantine fault tolerance.